Summary

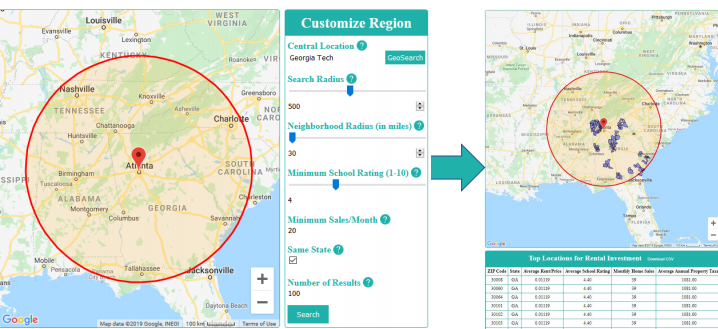

Investors looking to invest in rental properties can choose to do so remotely from anywhere in the US. However, the US is large and finding the right region to invest in is difficult. We provide a tool that allows investors to identify locations in the US that meet a set of personalized investment criteria, helping them make data-driven decisions about remote investment opportunities. We examine data at the zip code level, which is more granular than the city level data used in most analyses we found. We also allow the user to vary the size of the investment region. This can be useful to identify cases where multiple zip codes that are near each other contain good investment opportunities.

Methodology

We use a Cartesian Product to find all unique pairs of zip codes and then Haversine Distance to estimate the distance between each pair of zip codes. The user enters their customized criteria in the input fields and the tool will dynamically calculate price and rent ratios for each generated neighborhood and returns a list of the top neighborhoods by rent and price that meet the user defined criteria.

Data

The final combined dataset contains over 28 million rows and uses roughly 2.4 GB of space. Data source includes: Zillow, Policy Map, GreatSchools, Census Bureau.

Results

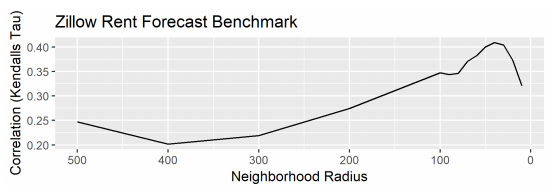

One way to measure whether our results are reasonable is to compare them with an industry benchmark. Zillow produces a rent forecast and we can measure how well our neighborhood rankings match with theirs. We observe positive correlation with our benchmark for every choice of neighborhood size, which is always statistically significant. The shape of the correlation curve is also intuitive, correlation is highest for small neighborhood sizes roughly the size of a city, since the industry forecasts are closest to city level granularity